Business Interruption Insurance

Protecting your business against unforeseen disruptions is crucial to maintaining financial stability. At DPI Insurance, we can advise on risk transfer programmes that include Business Interruption Insurance tailored to safeguard various aspects of your business. Our policies can help your operations to recover after an insured event. Discover our key coverage areas below and get a quote today to secure your business’s future.

What is Business Interruption Cover?

Business Interruption (BI) insurance helps your business recover the loss of income suffered due to physical property damage affecting your operations. To activate this coverage, a material damage claim must occur. Cover operates over an agreed timescale, referred to as an Indemnity Period.

Here’s how we support different business models:

Gross Profit

Designed for manufacturers, wholesalers, and retailers, Gross Profit coverage ensures that your business’ gross profit is maintained if your premises-based operations are halted or reduced. This policy covers the loss of income that directly results from the inability to produce and/or sell your products due to an insured event, such as fire or flood.

Gross Fees

For service-oriented businesses like consultants, solicitors, and accountants, Gross Fees coverage is essential. This insurance caters for companies that earn income through fees rather than selling products. If an event like an office fire disrupts your ability to serve clients, Gross Fees coverage will help compensate for the loss of income, allowing your business to continue operating.

Loss of Rent

Property owners can face significant financial challenges if an insured event, such as a fire or burst pipe, makes their tenanted property uninhabitable. Loss of Rent coverage protects your income if your property has to be vacated due to physical damage. It can also cover the additional expense of arranging alternative accommodation for your tenant.

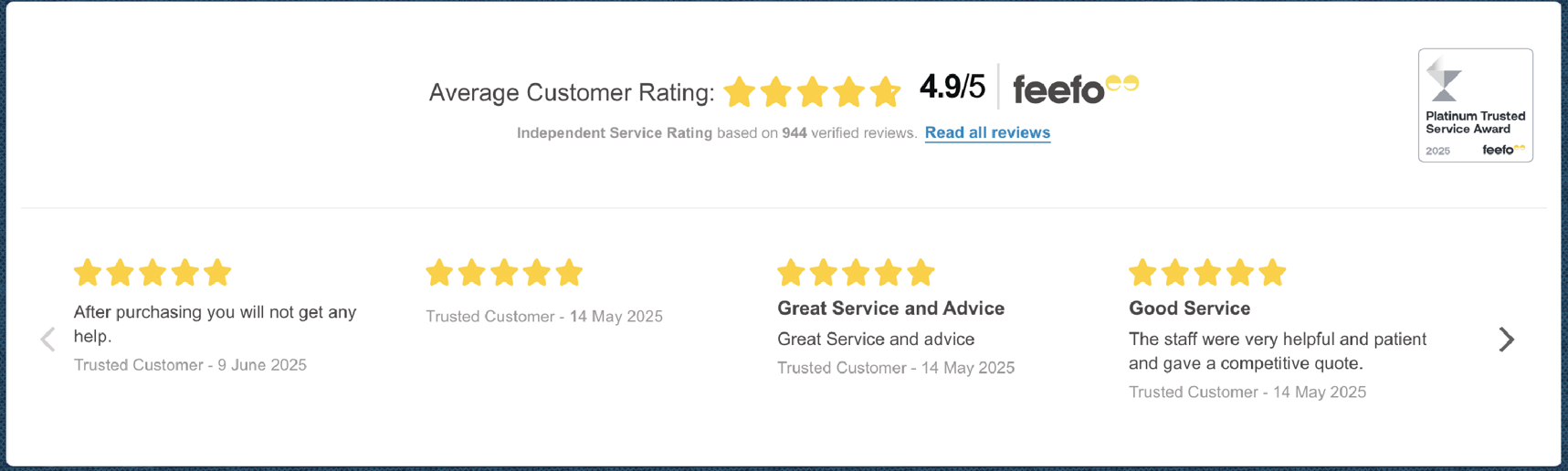

Consistently delivering excellent service

Our customers are at the forefront of our business and we are committed to providing the highest level of service possible. For the last six years we have achieved the Feefo Platinum Trusted Service Award, with a service rating of at least 4.9 / 5.

Tailored Policies

We carry out an in-depth fact-find to understand your business in detail. This ensures your policy is tailored to your personal needs without ever compromising on cover.

Competitive

We access an array of A rated & Lloyds Insurers, placing millions of pounds worth of insurance for our clients each year. Buying this volume ensures competitive pricing.

Customer Service

Our ongoing expert advice & friendly customer service has allowed us to gain an average service rating of 4.9 out of 5 from independent review site

Feefo.